Last month was particularly favorable for short volatility strategies. In this post, we will investigate the reasons behind it.

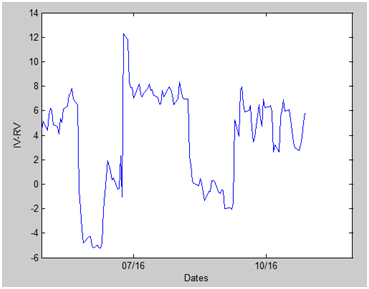

First, the main PnL driver of a delta neutral, short gamma and short vega strategy is the spread between the implied volatility (IV) and the subsequently realized volatility (RV) of returns. Trading strategies such as long butterfly is profitable when, during the life of the position, RV is low compared to IV. The graph below shows the difference between IV and RV for SP500 during the last 5 months. (Note that RV is shifted by 1 month, so that IV-RV presents accurately the spread between the implied volatility and the volatility realized during the following month). As we can see from the graph, IV-RV was high, around 4%-7%, during October (the area around the “10/16” mark). Hence short volatility strategies were generally profitable during October.

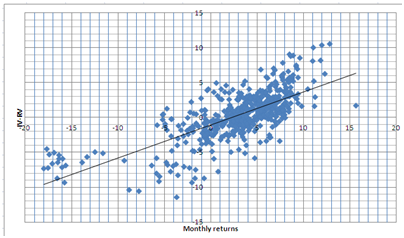

The second reason for the profitability is more subtle. The graph below shows the IV-RV spreads in function of monthly returns. As we can see, there is a high degree of correlation between IV-RV and the monthly returns. In fact, we calculated the correlation for the last 10 years and it is 0.69

This means that when IV-RV is high, SP500 usually trends up. This was the case, for example, during the month after Brexit (see the area around the “07/16” mark on the first graph). However, when the market trends, the cost of hedging in order to keep the position delta neutral is high. By contrast, even though IV-RV was high in October, the market moved in a range, thus helping us to minimize our hedging costs. This factor therefore contributed to the profitability of short volatility strategies.

In summary, October was favorable for short volatility strategies due to the high IV-RV spread and the range bound nature of the market.

Hi, On the scatterplot, you say “…the IV-RV spreads in function of monthly returns” – may i ask “monthly returns” of what ?

Than you

Of SPX. I just updated the captions. Thanks for asking

Thanks, you may also find this of interest, Vix single day spikes and consequent Vix returns N days later

https://voodoomarkets.wordpress.com/2016/12/19/vix-single-day-spikes-their-historical-returns