Volatility trading strategies

In previous posts, we presented 2 volatility trading strategies: one strategy is based on the volatility risk premium (VRP) and the other on the volatility term structure, or roll yield (RY). In this post we present a detailed comparison of these 2 strategies and analyze their recent performance.

The first strategy (VRP) is based on the volatility risk premium. The trading rules are as follows [1]:

Buy (or Cover) VXX if VIX index <= 5D average of 10D HV of SP500

Sell (or Short) VXX if VIX index > 5D average of 10D HV of SP500

The second strategy (RY) is based on the contango/backwardation state of the volatility term structure. The trading rules are as follows:

Buy (or Cover) VXX if 5-Day Moving Average of VIX/VXV >=1 (i.e. backwardation)

Sell (or Short) VXX if 5-Day Moving Average of VIX/VXV < 1 (i.e. contango)

Table below presents the backtested results from January 2009 to December 2016. The starting capital is $10000 and is fully invested in each trade (different position sizing scheme will yield different ending values for the portfolios. But the percentage return of each trade remains the same)

| RY | VRP | |

| Initial capital | 10000 | 10000 |

| Ending capital | 179297.46 | 323309.02 |

| Net Profit | 169297.46 | 313309.02 |

| Net Profit % | 1692.97% | 3133.09% |

| Exposure % | 99.47% | 99.19% |

| Net Risk Adjusted Return % | 1702.07% | 3158.54% |

| Annual Return % | 44.22% | 55.43% |

| Risk Adjusted Return % | 44.46% | 55.88% |

| Max. system % drawdown | -50.07% | -79.47% |

| Number of trades trades | 32 | 55 |

| Winners | 15 (46.88 %) | 38 (69.09 %) |

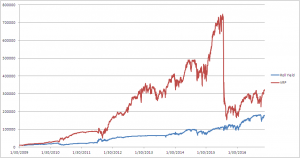

We observe that RY produced less trades, has a lower annualized return, but less drawdown than VRP. The graph below depicts the portfolio equities for the 2 strategies.

It is seen from the graph that VRP suffered a big loss during the selloff of Aug 2015, while RY performed much better. In the next section we will investigate the reasons behind the drawdown.

Performance during August 2015

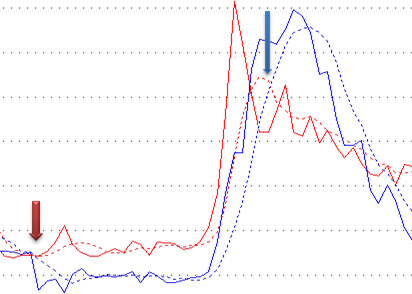

The graph below depicts the 10-day HV of SP500 (blue solid line), its 5-day moving average (blue dashed line), the VIX index (red solid line) and its 5-day moving average (red dashed line) during July and August 2015. As we can see, an entry signal to go short was generated on July 21 (red arrow). The trade stayed short until an exit signal was triggered on Aug 31 (blue arrow). The system exited the trade with a large loss.

The reason why the system stayed in the trade while SP500 was going down is that during that period, the VIX was always higher than 5D MA of 10D HV. This means that 10D HV was not a good approximate for the actual volatility during this highly volatile period. Recall that the expectation value of the future realized volatility is not observable. This drawdown provides a clear example that estimating actual volatility is not a trivial task.

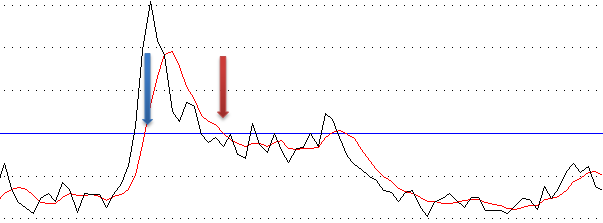

By contrast, the RY strategy was more responsive to the change in market condition. It went long during the Aug selloff (blue arrow in the graph below) and exited the trade with a gain. The responsiveness is due to the fact that both VIX and VXV used to generate trading signals are observable. The graph below shows VIX/VXV ratio (black line) and its 5D moving average (red line).

In summary, we prefer the RY strategy because of its responsiveness and lower drawdown. Both variables used in this strategy are observable. The VRP, despite being based on a good ground, suffers from a drawback that one of its variables is not observable. To improve it, one should come up with a better estimate for the expectation value of the future realized volatility. This task is, however, not trivial.

References

[1] T Cooper, Easy Volatility Investing, SSRN, 2013

Just came across this post. You cannot compare and test strategies using compounding like that. Your numbers end up being completely misleading. Instead use a fixed bet size each time, e.g. $10k or whatever number. What’s interesting is the average win, i.e. expected return per bet on average.

Thanks for your note. Yes I tested the strategies using a fixed position size. As noted above, the win/loss ratios and individual trades’ returns remain the same, although the ending equities were different. I’m currently comparing different sizing schemes (fixed, compounding, full Kelly, half Kelly etc.) Will keep you posted. Cheers

Hi, rvarb. In your RY strategy you say “sell VXX if…”. Did you mean “sell short” (or buy the inverse VIX futures ETN?). The futures are in backwardation only a small percentage of the time and if you are selling your long and going to cash it would not have the equity curve you show. It would be flat if it were in cash for so long. Nice post, thank you. Frank in NYC.

Hi Frank, the system is stop and reverse so when it sells it goes short as well. Thanks for pointing this out. I added a clarification to the signal description.

it may be working to use Forecasted Vol,like those from Garch model, to replace HV.

Yes, you can use GARCH as an estimator for RV. For a good discussion on various models for predicting the VRP, check out:

C. Bekaert and M. Hoerova, The VIX, the Variance Premium and Stock Market Volatility

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2252209