Tail risk hedging aims to protect portfolios from extreme market downturns by using strategies such as out-of-the-money options or volatility products. While effective in mitigating large losses, the challenge lies in balancing cost and long-term returns. In this post, we’ll discuss tail risk hedging and whether it can be done at a reasonable cost.

Tail Risk Hedging Strategies: Are They Effective?

Tail risk hedging involves purchasing put options to protect the portfolio either partially or fully. Reference [1] presents a study of different tail risk hedging strategies. It explores the effectiveness of put option monetization strategies in protecting equity portfolios and enhancing returns.

Findings

– Eight different monetization strategies were applied using S&P 500 put options and the S&P 500 Total Return index from 1996 to 2020.

– Results compared against an unhedged index position and a constant volatility strategy on the same underlying index.

– Tail risk hedging, in this study, yielded inferior results in terms of risk-adjusted and total returns compared to an unhedged index position.

– Over a 25-year period, all strategies’ total returns and Sharpe ratios were worse than the unhedged position.

– Buying puts involves paying for the volatility risk premium, contributing to less favorable results.

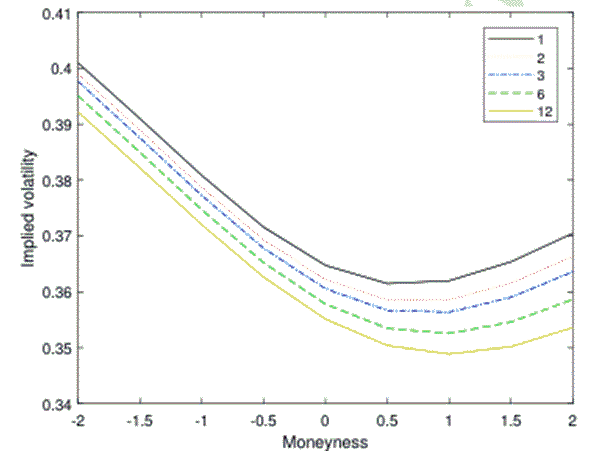

– The results are sensitive to choices of time to expiry and moneyness of purchased options in tested strategies.

– The authors suggest the possibility of minimizing hedging costs by optimizing for strikes and maturities.

Reference:

[1] C.V. Bendiksby, MOJ. Eriksson, Tail-Risk Hedging An Empirical Study, Copenhagen Business School

How Can Put Options Be Used in Tail Risk Hedging?

The effectiveness of using put options to hedge the tail risks depends on the cost of acquiring put options, which can eat into investment returns. Reference [2] proposes a mixed risk-return optimization framework for selecting long put options to hedge S&P 500 tail risk. It constructs hypothetical portfolios that continuously roll put options for a tractable formulation.

Findings

– The article discusses the effectiveness of tail risk hedging. It highlights that the premium paid for put options can be substantial, especially when continuously renewing them to maintain protection. This cost can significantly impact investment returns and overall portfolio performance.

– The article introduces an optimization-based approach to tail-risk hedging, using dynamic programming with variance and CVaR as risk measures. This approach involves constructing portfolios that constantly roll over put options, providing protection without losing significant long-term returns.

– Contrary to previous research, the article suggests that an effective tail-risk hedging strategy can be designed using this optimization-based approach, potentially overcoming the drawbacks of traditional protective put strategies.

-The proposed hedging strategy overcame traditional drawbacks of protective put strategies. It outperforms both direct investments in the S&P 500 and static long put option positions.

Reference

[2] Yuehuan He and Roy Kwon, Optimization-based tail risk hedging of the S&P 500 index, THE ENGINEERING ECONOMIST, 2023

Closing Thoughts

Tail risk hedging is expensive. While the first paper demonstrated that tail risk hedging leads to inferior returns, it suggested that results could be improved by optimizing strike prices and maturities. The second paper built on this idea and proposed a hedging scheme based on optimization. The proposed strategy outperforms both direct investments in the S&P 500 and static long put option positions.