Beta is a measure of an asset’s sensitivity to market movements, indicating how much its price is expected to change in relation to the overall market. Beta is often used in CAPM and the calculation of WACC. However, it can also be applied in trading, specifically in arbitrage. In this post, I’ll discuss beta arbitrage.

Beta Arbitrage Around Macroeconomic Announcements

The macroeconomic announcement premium refers to the phenomenon where financial markets experience higher-than-usual returns on days when significant macroeconomic announcements are made.

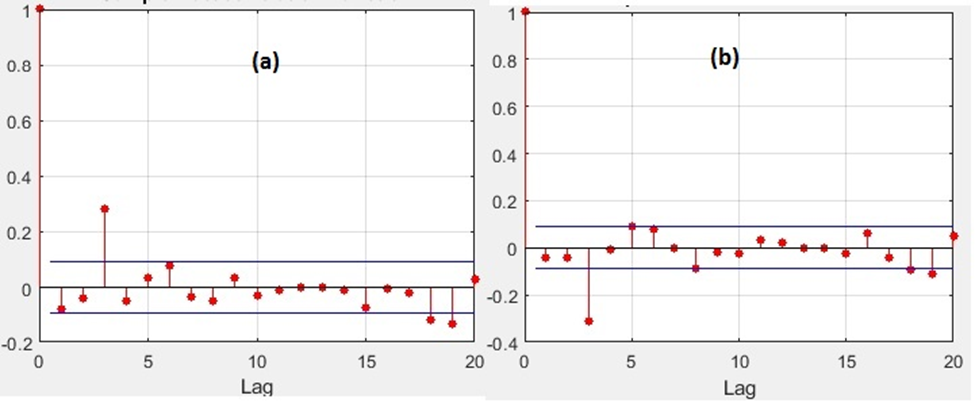

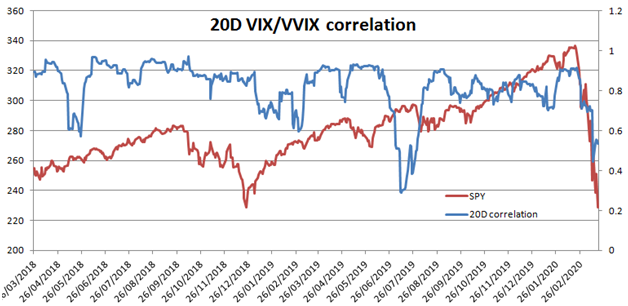

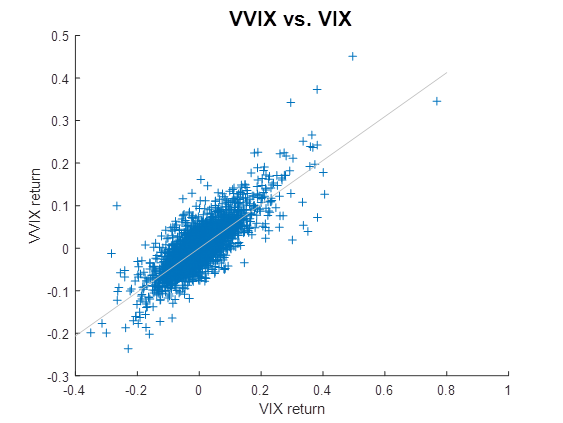

Reference [1] studies the dynamics of high-beta stock returns around macroeconomic announcements.

Findings

– Stocks in the top beta-decile show distinct return patterns: negative returns before announcements (-0.075%), positive on announcement days (0.164%), and negative again after (-0.093%).

– The beta premium experiences significant fluctuations around macroeconomic announcements, with a swing driven by high-beta stock returns.

– A long-short strategy involving betting against beta (BAB) before and after announcements, and betting on beta (BOB) on announcement days, can yield an annualized return of 25.28%.

– Liquidity effects explain pre-announcement high-beta returns, while risk has a weak but consistent pattern around announcements.

– Investor risk aversion shifts significantly explain the variation in beta returns around announcements.

– Liquidity, risk, and investor risk appetite only partially account for variations in high-beta stock returns.

Reference

[1] Jingjing Chen, George J. Jiang, High-beta stock valuation around macroeconomic announcements, Financial Review. 2024;1–26.

Beta Arbitrage: Betting on Stock Comovements

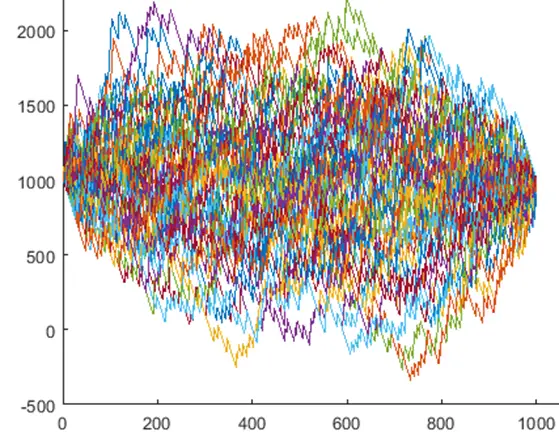

This trading strategy is based on the assumption that stock betas tend to mean regress towards one in the long run, leading to exploitable comovement patterns in stock prices.

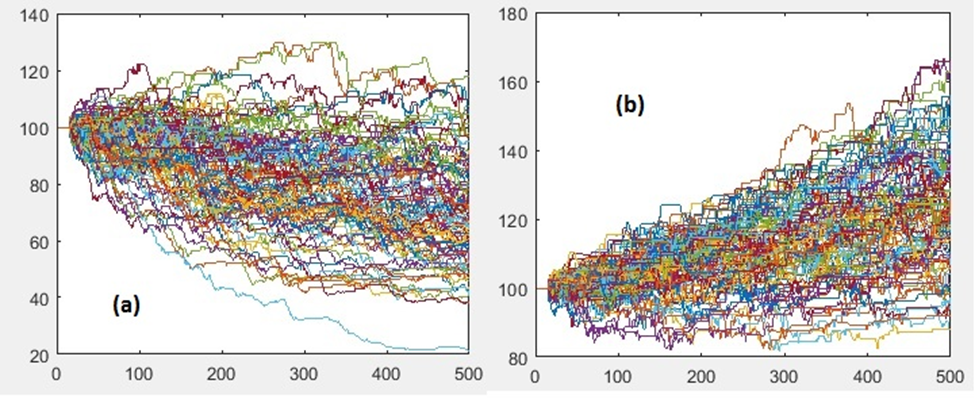

Reference [2] discusses a model for S&P 500 index changes, involving two beta-based styles: index trackers and beta arbitrageurs. The comovement effect has two components, influenced by low and high beta stocks in pre-event scenarios.

The paper presents a stylized model for S&P 500 index changes, highlighting the distinct components of comovement effects and the exploitable nature of beta arbitrage.

Findings

-Beta arbitrage is a trading strategy that capitalizes on the belief that betas tend to mean regress towards one over time.

– This paper develops a model for S&P 500 index changes, focusing on two beta-based trading styles: index trackers and beta arbitrageurs.

– Index trackers follow the index, while beta arbitrageurs trade both high and low beta event stocks to exploit mean reversion toward one.

– Arbitrageurs employ common or contrarian trading patterns depending on whether a stock’s historical beta is below or above one.

– The overall comovement effect of index changes has two components:

1- Pre-event low beta stocks experience beta increases due to common demand from both indexers and arbitrageurs.

2- Arbitrageurs short high beta additions, reducing or reversing beta increases caused by indexers.

– Similar patterns are observed for stocks deleted from the index.

Reference

[2] Yixin Liao, Jerry Coakley, Neil Kellard, Index tracking and beta arbitrage effects in comovement, International Review of Financial Analysis, Volume 83, October 2022, 102330

Closing Thoughts

Beta is more than a measure of an asset’s sensitivity to market movements or a key component in financial models like CAPM and WACC. Its application extends to trading strategies, particularly beta arbitrage, where investors exploit discrepancies in beta values to identify profitable opportunities.