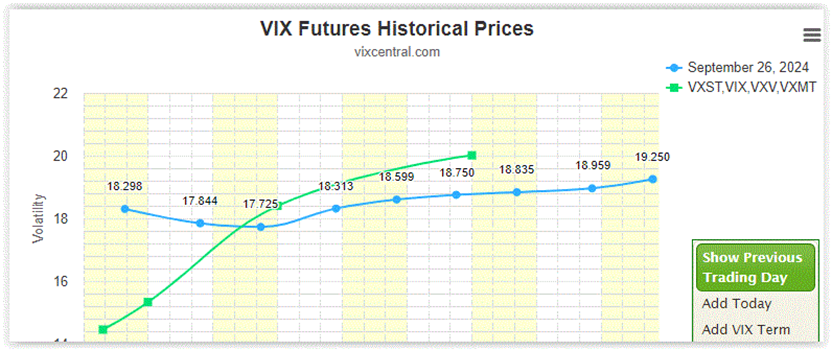

With the U.S. election now over, the VIX futures term structure has normalized. It typically follows the spot VIX term structure. However, before the election, the futures term structure was in backwardation while the spot VIX was in contango most of the time. This is a rare occurrence. Below is a snapshot of the spot and futures term structures on September 26.

In a future issue, I’ll present statistics and trade opportunities for such situations. In today’s issue, however, I will discuss two papers that develop trading systems for VIX futures.

Trading VIX Futures Using Neural Networks

Reference [1] explores the use of neural networks, a type of artificial intelligence, to trade VIX futures. The authors assume that the term structure of VIX futures follows a Markov model. An interesting aspect of this paper is that it made use of a utility function to generate trading signals. The authors also performed thorough out-of-sample testing using the k-fold cross-validation technique.

The Model

- The trading strategy aims to maximize expected utility for a day-ahead horizon considering the current shape and level of the term structure.

- Computationally, a deep neural network with five hidden layers models the functional dependence between the VIX futures curve, positions, and expected utility.

- Out-of-sample backtests indicate that this method achieves good portfolio performance.

Validation

- The standard procedure for training involves dividing the data into two blocks: one for in-sample training and the other for out-of-sample testing.

- VIX futures curves from April 14th, 2008, to August 7th, 2019, are used for in-sample training, while the remaining curves from August 8th, 2019, to November 5th, 2020, are used for out-of-sample testing.

- Since the out-of-sample test is based on a single portfolio run, good performance could be attributed to luck. Therefore the method of k-fold cross-validation is applied.

Reference

[1] M. Avellaneda, T. N. Li, A. Papanicolaou, G. Wang, Trading Signals In VIX Futures, Applied Mathematical Finance. 2021;28(3):275–298

Trading VIX Futures Using Machine Learning Techniques

Building on the first paper, Reference [2] investigates machine learning techniques for trading VIX futures. It proposed using Constant Maturity Futures (CMF) to generate trading signals for VIX futures. It applied machine learning models to create these signals.

Findings

- The experiment results show that term structure features, such as μt and ∆roll, are highly effective in predicting the next-day returns of VIX CMFs and offer potential economic benefits.

- The C-MVO strategy outperformed the benchmark rank-based long-short strategy in backtesting across most machine learning models, offering valuable insights for trading VIX CMFs.

- Neural network models, particularly ALSTM, demonstrated the best performance in both prediction and backtesting.

- Tree-based models showed no clear superiority, while the linear regression model, which only considers linear relationships, outperformed all other models.

- The findings highlight the predictive power of term structure features for next-day returns in VIX CMFs.

Reference

[2] Wang S, Li K, Liu Y, Chen Y, Tang X (2024), VIX constant maturity futures trading strategy: A walk-forward machine learning study, PLoS ONE 19(4): e0302289

Closing Thoughts

These papers present trading systems developed using advanced techniques in machine learning and AI. As such, validation is critical. Techniques such as k-fold validation and walk-forward analysis should be carried out rigorously.

The research also suggests that there is valuable information embedded in the VIX futures term structure. In my opinion, “simple”, intuitive systems can be developed using VIX term structure that can provide decent risk-adjusted returns. Additionally, as I’ve discussed in one of my LinkedIn posts, the S&P 500 market generally leads the VIX market. Therefore, signals from the S&P 500 can also be used to trade VIX futures.

Let me know your thoughts in the comments below.