I recently covered calendar anomalies in the stock markets. Interestingly, patterns over time also appear in the volatility space. In this post, I’ll discuss the seasonality of volatility risk premium (VRP) in more detail.

Breaking Down the Volatility Risk Premium: Overnight vs. Intraday Returns

The decomposition of the volatility risk premium (VRP) into overnight and intraday components is an active area of research. Most studies indicate that the VRP serves as compensation for investors bearing overnight risks.

Reference [1] continues this line of research, with its main contribution being the decomposition of the variance risk premium into overnight and intraday components using a variance swap approach. The study also tests the predictive ability of these components and examines the seasonality (day-of-week effects) of the VRP.

An interesting finding of the paper is the day-of-week seasonality. For instance, going long volatility at the open and closing the position at the close tends to be profitable on most days, except Fridays.

Findings

-The analysis is conducted on implied variance stock indices across the US, Europe, and Asia.

-Results show that the VRP switches signs between overnight and intraday periods—negative overnight and positive intraday.

-The findings suggest that the negative VRP observed in previous studies is primarily driven by the overnight component.

-The study evaluates the predictive power of both intraday and overnight VRP in forecasting future equity returns.

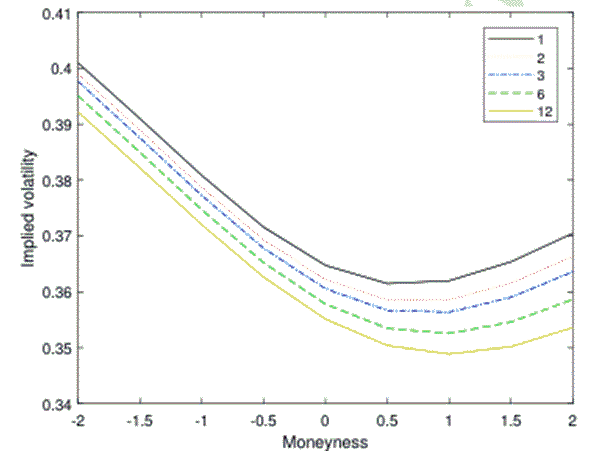

-The intraday VRP component captures short-term risk and demonstrates predictive ability over 1–3-month horizons.

-The overnight VRP component reflects longer-term risk and shows predictive power over 6–12-month horizons.

Reference

[1] Papagelis, Lucas and Dotsis, George, The Variance Risk Premium Over Trading and Non-Trading Periods (2024), SSRN 4954623

Volatility Risk Premium Seasonality Across Calendar Months

Reference [2] examines the VRP in terms of months of the year. It concluded that the VRP is greatest in December and smallest in October.

An explanation for the large VRP in December is that during the holiday season, firms might refrain from releasing material information, leading to low trading volumes. The combination of low trading volume and the absence of important news releases would result in lower realized volatility.

Findings

-The paper identifies a “December effect” in option returns, where delta-hedged returns on stock and S&P 500 index options are significantly lower in December than in other months.

-This effect is attributed to investors overvaluing options at the start of December due to underestimating the typically low volatility that occurs in the second half of the month.

– The reduced volatility is linked to lighter stock trading during the Christmas holiday season.

– A trading strategy that involves shorting straddles at the beginning of December and closing the position at the end of the month yields a hedged return of 13.09%, with a t-value of 6.70.

-This return is much higher than the unconditional sample mean of 0.88%, highlighting the strength of the effect.

The paper is the first in academic literature to document and analyze this specific December anomaly in option markets. It is another important contribution to the understanding of the VRP.

Reference

[2] Wei, Jason and Choy, Siu Kai and Zhang, Huiping, December Effect in Option Returns (2025). SSRN 5121679

Closing Thoughts

In this post, I have discussed volatility patterns in terms of both days of the week and months of the year. Understanding this seasonality is crucial for traders and portfolio managers, as it can inform better timing of volatility trades and risk management strategies.