A good reward/risk trade is a one where fundamentals and technicals are aligned. We have seen two fundamentally similar countries (Canada/Australia) but they did not make a good pair for short-term trading. We have also seen two seemingly different economies (Australia/Indonesia) but that made a good pair.

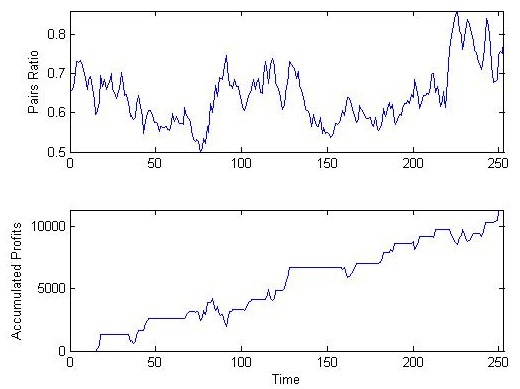

There exist, however, some pairs that have good technical and fundamental relationships. India (INDL) and Russia (RUSL) are two emerging markets; they are part of the BRIC countries. The ratio chart (upper panel, below) exhibits a regular oscillating pattern, albeit somewhat volatile. The backtested equity line (lower panel) is, however, orderly upward.

Backtest results showed a winning percentage of 88% and a profit factor of 1.86, so this is a good pair to trade. As a bonus, these stocks are leveraged ETFs, hence the pair is also suitable for intra-day scalping.