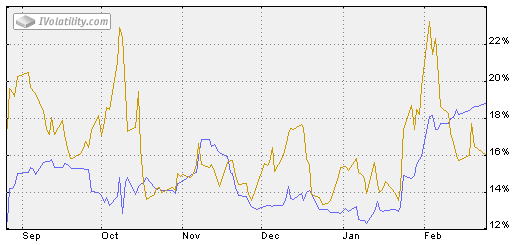

The phenomenon of the favorite long-shot bias (or volatility risk premium) can be exploited in order to construct a profitable options trading strategy. Basically, such a strategy would consist of selling overpriced options and hedging the risks using cheaper (or more precisely less overpriced) options. As can be seen from the graph below, the implied volatility (IV, yellow line) is generally higher than the historical volatility (HV, blue line). However, as of late, IV deepened below HV, which is rather unusual. A premium selling strategy in this kind of volatility environment might still profitable. However, the risks will likely outweigh the rewards.

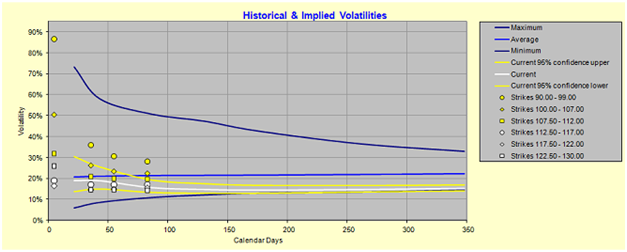

The cheapness of IV is also confirmed by the volatility cone. As can be seen below, at the money IV, (depicted in white diamonds) is below the current HV (depicted by the white line).

A long volatility trade will have a higher probability of success in this kind of market.