Statistical arbitrage trading relies on, among other factors, the correlation between stocks. It is important to note, however, that correlation, like volatility, is not static, but time dependent and changing. Different market condition has a different level of correlation, and this has an important implication for stat-arb trading PnL.

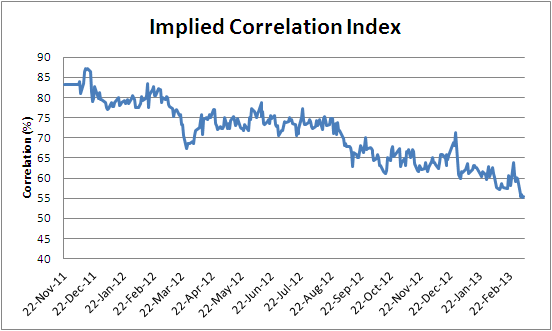

We have been in a bull market lately, and it’s fairly common in bull markets for correlations to relax. The chart below depicts the CBOE Implied Correlation Index for SP500 stocks from November 2011 to March 2013. As we can see from the graph, the correlation is in a downtrend; it decreased from 80 % in Dec 2011 to about 55% in early March 2013.

The decrease in correlation explains in part why we have observed lots of dislocated pair relationships lately. This dislocation increased the likelihood of pair divergence, hence one should exercise more caution when choosing pairs.