In the previous post, we looked at some statistical properties of the empirical distributions of spot SPX and VIX. In this post, we are going to investigate the mean reverting and trending properties of these indices. To do so, we are going to calculate their Hurst exponents.

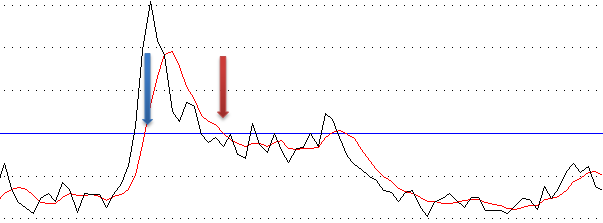

There exist a variety of techniques for calculating the Hurst exponent, see e.g. the Wikipedia page. We prefer the method presented in reference [1] as it could be related to the variance of a Weiner process which plays an important role in the options pricing theory. When H=0.5, the underlying is said to be following a random walk (GBM) process. When H<0.5, the underlying is considered mean reverting, and when H>0.5 it is considered trending.

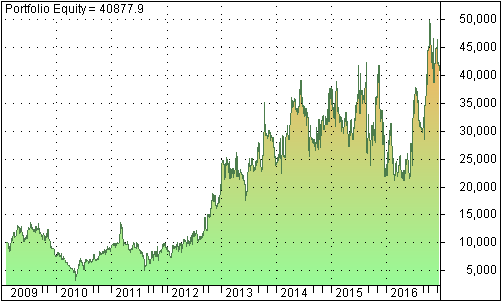

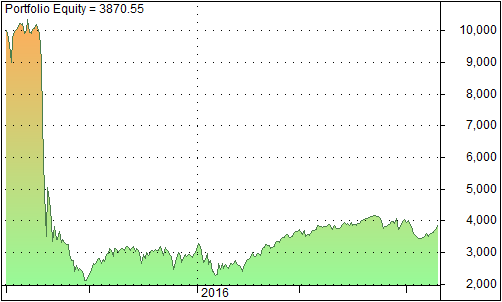

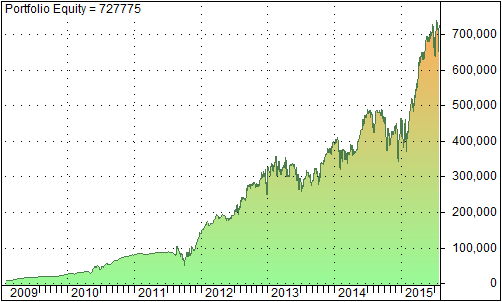

Table below presents the Hurst exponents for SPX, VIX and VXX. The data used for SPX and VIX is the same as in the previous post. The data for VXX is from Feb 2009 to the present. We display Hurst exponents for 2 different ranges of lags: short term (5-20 days) and long term (200-250 days).

| Lag (days) | SPX | VIX | VXX |

| 5-20 | 0.45 | 0.37 | 0.46 |

| 200-250 | 0.51 | 0.28 | 0.46 |

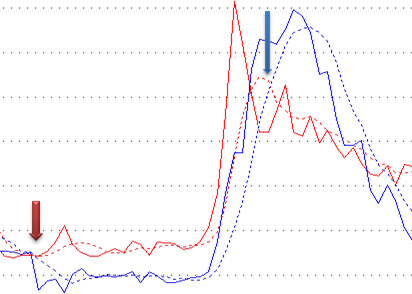

We observe that SPX is mean reverting in a short term (average H=0.45) while trending in a long term (average H=0.51). This is consistent with our experience.

The result for spot VIX (non tradable) is interesting. It’s mean reverting in a short term (H=0.37) and strongly mean reverting in a long term (H=0.28).

As for VXX, the result is a little bit surprising. We had thought that VXX should exhibit some trendiness in a certain timeframe. However, VXX is mean reverting in both short- and long-term timeframes (H=0.46).

Knowing whether the underlying is mean reverting or trending can improve the efficiency of the hedging process.

References

[1] T. Di Matteo et al. Physica A 324 (2003) 183-188